Overview of Vietnam’s Export Performance

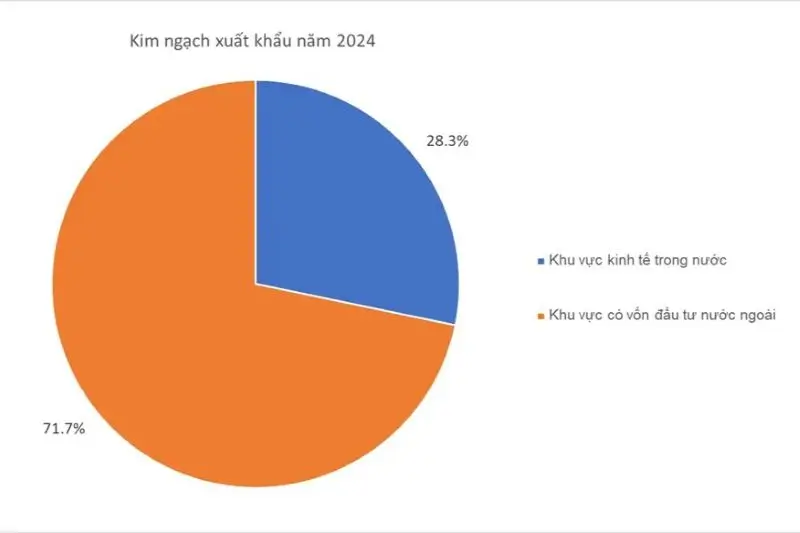

In 2024, Vietnam’s total export value reached USD 405.53 billion, up 14.3% year-on-year. Domestic enterprises accounted for USD 114.59 billion (28.3%), growing nearly 20% – higher than the FDI sector but still holding a smaller share, indicating great potential for growth if properly supported.

In Q1/2025, export value was estimated at USD 102.84 billion (+10.6% YoY), with 18 product categories exceeding USD 1 billion in export turnover. Among these, five surpassed USD 5 billion, making up nearly 60% of total exports.

Kim ngạch xuất khẩu năm 2024

Five Key Export Categories Poised for Growth

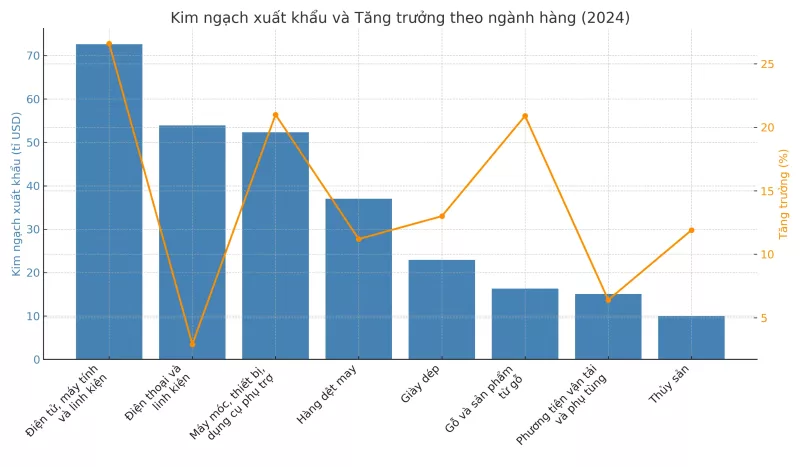

Electronics, Computers, and Components

Export value reached USD 72.6 billion in 2024 (+26.6%) driven by global supply chain shifts and increasing technology demand.

Machinery and Equipment

Reached USD 14.48 billion (+13.84%) thanks to domestic industrial support policies and technical cooperation.

Textiles, Garments, and Footwear

Exported over USD 10 billion by mid-April 2025, up 10.58%, boosted by recovery in the US and EU markets, and favorable FTAs like EVFTA and CPTPP.

Processed Agricultural Products and Seafood

USD 9.8 billion in Q1/2025 (+12.8%), with fruits and vegetables growing over 20% due to demand for sustainable and safe food.

Wood and Furniture Products

Export rose over 20% in 2024, with high demand in the US and EU for certified, eco-friendly furniture.

Kim ngạch xuất khẩu và tăng trưởng theo ngành hàng (2024)

Global Factors Impacting Export Performance

-

Supply chain disruption: Red Sea crisis, natural disasters, and rising logistics costs in Vietnam.

-

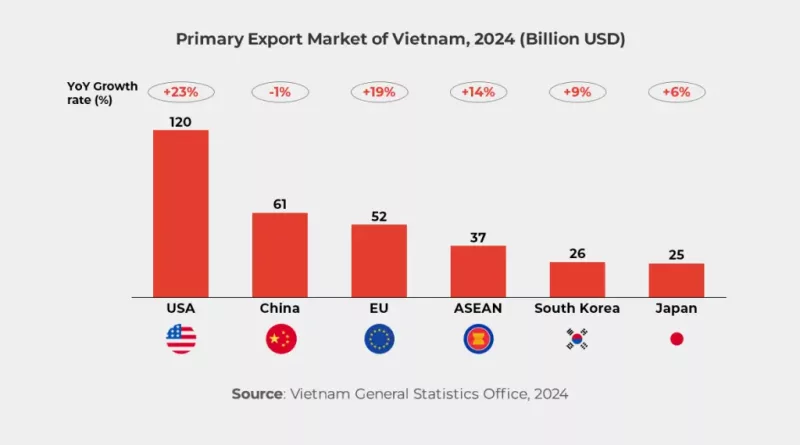

Geopolitical tensions: Potential US tariffs due to trade surplus with Vietnam exceeding USD 120 billion.

-

Environmental and technical standards: Strict regulations from US and EU markets.

-

Rising regional competition: ASEAN countries such as Thailand, Malaysia, and Cambodia accelerating exports.

Strategic Responses for Sustainable Growth

-

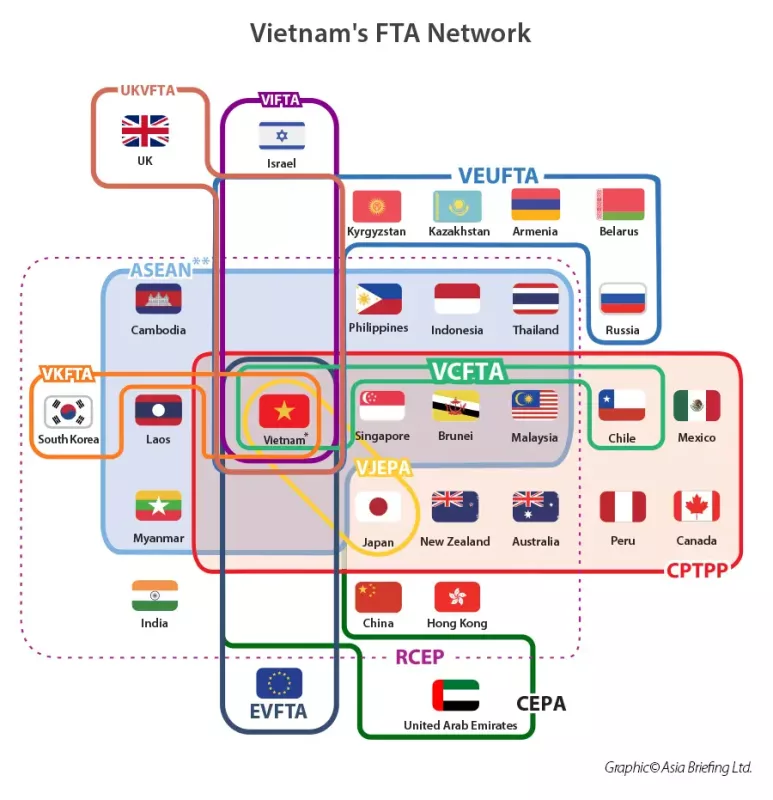

Leverage 17 active Free Trade Agreements (EVFTA, CPTPP, RCEP).

-

Promote cross-border e-commerce through platforms like Amazon, Alibaba.

-

Invest in production technology and origin traceability systems.

-

Adopt circular economy and green logistics solutions.

Thị trường xuất khẩu chính của Việt Nam năm 2024

US Tariff Scenarios and Exporter Strategies

| Tariff Level | Impact | Suggested Strategy |

|---|---|---|

| 10% | Moderate | Optimize logistics, add value, use FTAs effectively |

| 20–25% | Significant | Shift to new markets, partial processing abroad |

| 45% | Severe | Refocus on EU, Middle East, and e-commerce channels |

Thặng dư thương mại giữa Việt Nam với Mỹ (2014-2024)

Strategic Roadmap for Exporters

-

Diversify export markets and avoid over-reliance on any one market

-

Upgrade processing capabilities and increase value-added content

-

Develop direct e-commerce export channels

-

Ensure traceability and transparency in supply chain

-

Integrate circular economy and sustainability into operations

-

Maximize FTA benefits and government export support programs

Sources:

- Cổng thông tin điện tử Bộ Công Thương (MOIT)

- Cổng thông tin điện tử Bộ Kế hoạch và Đầu tư (www.mpi.gov.vn)

- Trang thông tin điện tử Cục Thống kê

- Tạp chí Kinh tế – Tài chính Hải quan Online

- Tạp chí Tài chính điện tử – Bộ Tài chính